The Washington Post recently highlighted how for the third year in a row our Washington area streets have had over 100 pedestrian deaths per year.

While numbers on the national level seem to be declining slightly, in the Washington D.C. area, they continue to grow as the range of pedestrians killed per 100,000 residents:

- From 2015-2018: 1 in 100,000 residents

- In 2022, 2023, 2024: 2 in 100,000 residents

The Post Highlights Key Factors:

- Jonathan Adkins, Governors Highway Safety Association, is encouraged by added pedestrian infrastructure across the region.

- Sharon Kershbaum, director of the DC Department of Transportation, stated the vast majority of deaths last year — nearly 80 percent — “were tied to reckless and antisocial behavior” that is difficult to combat through engineering alone.

- While reviewing the data across Maryland, Virginia and DC, Post analysis found both structural and personal factors contributing to the spike in deaths, including poorly lit roads and more crashes involving alcohol. In fact, 73 pedestrians in Montgomery County, Prince George’s County and Northern Virginia were killed from 2022 to 2024 where dark roads were a contributing factor.

- In addition, as traffic enforcement has decreased since the pandemic, deaths have gone up. While DC invested heavily in automated traffic enforcement after the pandemic leading to 2 million speed-related infractions in 2024, many fewer tickets were issued by officers. The Post found in 2019, DC police officers issued more than 10,000 speed related citations, but between 2023 and 2024 the department issued just over 4,650.

- Law enforcement has also addressed concerns with hit-and-runs as Prince Georges County police investigated 13 fatal hit-and-runs involving pedestrians in 2024, up from 7 in 2023. Of the 15 fatal hit-and-run crashes in 2024 in D.C., not a single driver has been charged for any of these events.

- Maryland and Virginia lawmakers have proposed legislation to expand their speed cameras beyond work and school zones. Maryland and DC are looking at ways to sue out-of-state drivers for failure to pay automatic tickets issued by traffic cameras.

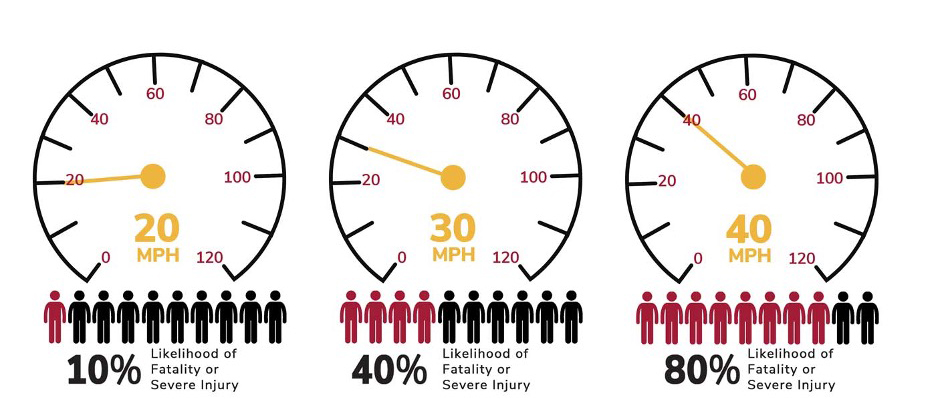

Small Changes in Speed Can Have Big Impacts

As people travel fast, the risk of death or serious injury rises dramatically. The diagram below shows that a pedestrian or bicyclist struck by a motorist driving 40 mph is EIGHT times more likely to die than a pedestrian or bicyclist struck at 20 mph.

While Laws Across the DMV Are Similar, They Are Not Identical

While Maryland, Virginia, and DC law generally prohibits people from recovering compensation after an accident if they contribute to their own injuries, DC has an exception when it comes to pedestrians and cyclists. In some cases, pedestrians and cyclists can still seek compensation even if they are partially to blame for a crash.

DC is a tourist destination. With visitors from across the globe, the city must strive to protect citizens and visitors alike. DC’s pedestrian laws govern a broad range of behavior. (PDF)

- All intersections are considered crosswalks, regardless of how they are marked. Pedestrians have the right of way in both marked and unmarked crosswalks and should always use crosswalks if available.

- Pedestrians must follow traffic signs if available and must walk on the sidewalk, facing oncoming traffic.

- DC Right of Way rules that at a pedestrian crossing with no signals, drivers must stop to yield to pedestrians and drivers must let them safely reach the other side before making their way across the crosswalk. On sidewalks, pedestrians have the complete right of way. Pedestrians also have the right of way over vehicles turning on a green light.

- However, pedestrians cannot cross an intersection diagonally unless it is authorized by traffic control signs. It is also against the law for pedestrians to suddenly enter the street if it causes a traffic hazard and pedestrians can get tickets for jaywalking. Be careful drivers, even if a pedestrian receives a jaywalking ticket, you may still be held liable in a civil case in court depending on the circumstances.

Under Virginia law, a pedestrian is considered anyone not operating a car, truck, motorcycle or any other motor vehicle, including bicyclists, skateboarders, and roller skates. Virginia law requires drivers to yield to pedestrians at all crosswalks when they are present, and pedestrians may not obstruct traffic or engage in behavior which would put them at risk of being hit by a motor vehicle. § 46.2-924

- At crosswalks, pedestrians are not allowed to walk outside of crosswalks and only have the right of way in marked crosswalks. Pedestrians must use the “walk” and “don’t walk” signs. Pedestrians in crosswalks have the right of way over all vehicles including those turning right on red.

- Virginia does follow contributory negligence laws which does mean that when assigning blame, even if a pedestrian is 1% at fault for the accident, they are not allowed to seek compensation for their injuries.

- Pedestrians should stay out of the way of oncoming traffic, be alert and cautious at intersection. Pedestrians may not enter or cross an intersection in disregard for approaching traffic.

In 2021, Maryland enacted the Maryland Vulnerable Road User law which has strong penalties aimed at protecting pedestrians with fines up to $2000 per violation, plus points for convicted violators. Maryland laws are similar to Virginia.

- At crosswalks, if a pedestrian is on the half of the roadway where the driver’s vehicle is traveling or is approaching the half of the roadway where the driver’s vehicle is traveling, drivers must come to a complete stop and other vehicles are not allowed to pass vehicles currently stopped to allow for pedestrians to pass.

- Pedestrians have the right of way to a turning vehicle in a crosswalk, but pedestrians must comply with the same red and green lights drivers do. Pedestrians must always use crosswalks and sidewalks when available and never cross an intersection diagonally.

Let’s All Get There Safely

Pedestrian safety affects young and old, drivers and walkers, during the day and at night. Everyone can be a pedestrian in some capacity at one point or another. Intoxication, ignorance, or inattentiveness by either or both motorists or pedestrians may can cause injuries and fatalities.

Slow down, pay attention, and always be alert for pedestrians and bicyclists.

Pedestrians and Drivers Share the Same Roads

If you were the victim of a pedestrian accident, there are some important things to do right away:

- Call the Police

- Seek Medical Assistance

- Take pictures of the scene, ask about witnesses (names and numbers)

- Document your injuries

- Do not discuss fault at the scene or with the other driver’s insurance company

Speak to an Experienced Pedestrian Law Attorney

You can protect your legal rights, experienced attorneys know how to get you fair compensation if you are injured in a pedestrian accident in Maryland, Virginia or the District of Columbia.